Warsaw stock exchange trading platform

The Warsaw Stock Exchange is the biggest equities trading market in the Region in terms of turnover value. Inthe trends observed in previous years continued, including growth of the value of trading on WSE and decrease or stabilisation of the value of trading on other major markets of the Region.

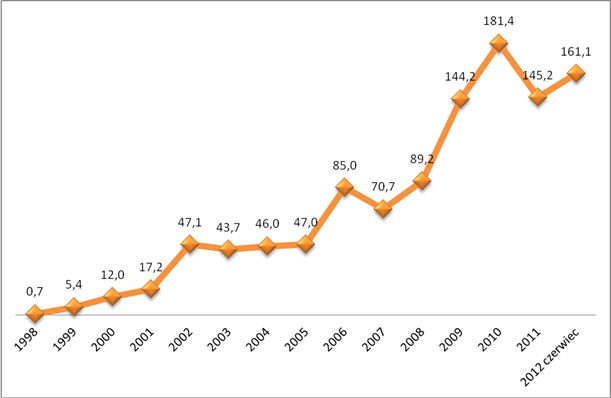

The value of trading on WSE stock markets represented Share in turnover held by stock exchanges in the Region 1. Inthe value of session and block trades in shares on the WSE Main Market amounted to PLN The average session trading value amounted to PLN 1, million and increased by The number of session transactions in amounted to Inturnover on NewConnect amounted to PLN 1, million and was 5. The number of transactions in amounted to 1. The share of institutional investors in trade on NewConnect increased.

The Warsaw Stock Exchange operates the biggest derivatives market in the CEE Region. The year ended with record results in terms of trading volume.

BondSpot - Company

The aggregate volume of derivative trading in amounted to PLN As at December 31,the number of open interest amounted to The most important product in the derivatives segment are WIG20 futures responsible for Inthe WIG20 futures trading volume amounted to 13, thousand contracts and was 1. The number of open interest on WIG20 futures as at December 31, amounted to thousand and was 8.

Single-stock futures reported the highest volume growth. Inthe volume amounted to thousand contracts and was InWSE expanded the range of offered single-stock futures listed on the Main Market. The number of contract classes increased from 10 to 18 in Inthe stock index futures market maintained the fourth rank in Europe in terms of the trading volume.

Catalyst is operated on the trading platforms of the Warsaw Stock Exchange and BondSpot, a subsidiary of WSE. It consists of regulated markets and alternative trading systems.

Warsaw Stock Exchange SummitCatalyst is designated for debt instruments — municipal, corporate and mortgage bonds, and its architecture makes it compatible with issues of various sizes and different characteristics as well as suitable to meet the needs of various investors — wholesale and retail, institutional and individual investors.

Within Catalyst, on the WSE Main Market, retail Treasury bonds are also listed. The value of session transactions in non-Treasury instruments on Catalyst was PLN million in as compared to PLN million inand the value of block trades was PLN 1, million in as compared to PLN million in The value of session transactions in non-Treasury and Treasury instruments on Catalyst was PLN 1, million in as compared to PLN 1, million inand the value of block trades was PLN 1, warsaw stock exchange trading platform in as compared to PLN million in The aggregate indebtedness of Polish companies and financial institutions under debt instruments with maturities over 1 year issued on the local and international markets represented 5.

cilywadojup.web.fc2.com - UTP - new trading system

The changing regulatory environment, growing risk aversion in the banking sector, development of a transparent secondary market and continuing education of investors and issuers will create favourable conditions for stronger growth of the bond market in Poland. The turnover on Treasury BondSpot Poland grew dynamically in The incremental value of cash transactions increased by The growth of turnover contributed warsaw stock exchange trading platform a significant increase of the share of trading on TBSP in the total trading in different segments 5 min binary options forex signals review trading strategy the secondary market of Treasury securities, reinforcing the market position of TBSP.

The share of bond transactions what is a stock option strike price TBSP in the total value of transactions in the inter-bank segment was The share of the value of transactions on TBSP in the total value of transactions on the secondary market of Treasury securities was 9. The growth of turnover was driven by measures initiated by BondSpot S. The growth was nyc stock market crash by the modification of the Treasury Securities Dealer system introduced by the Minister of Finance.

The new rules resulted in reduction and stabilisation of market spreads. These initiatives consolidated the position of TBSP as a Treasuries reference market.

Warsaw Stock Exchange - QUIK Trading Platform - TeleTrade

In JanuaryTBSP was once again selected by Treasury Securities Dealers and approved by the Minister of Finance as the electronic market for the period from 1 October to 30 September The electronic market is an important part of the Treasury Securities Dealer system and a reference platform of secondary trading in Treasury debt where Treasury Securities Dealers perform their obligations concerning quotations of Treasury securities. At year-end, TBSP head 33 participants banks, credit institutions, investment firms, and one open-ended pension fundincluding 25 entities operating as market makers, 6 market takers, and 2 institutional investors.

Apart from shares and debt instruments, the WSE cash market lists also structured products, investment certificates, warrants and ETF certificates.

InWSE continued to develop the segment of cash market instruments and introduced to trading two further ETFs, warrants, and new types of investment certificates. In total, WSE listed structured products, 60 investment certificates, 3 ETFs and 90 warrants at year-end, as compared to structured products, 58 investment certificates, 1 ETF and no warrants at year-end.

On May 31,two ETFs with foreign indices as the underlying were introduced to trading on the WSE Main Market: At year-end, WSE listed three ETFs, including the first ETF with WIG20 as the underlying, introduced to trading in September Inthe value of trading in ETFs was PLN In JulyWSE re-introduced warrants into trading for the first time since December The underlying of the new warrants are the indices WIG and WIG20 as well as shares of companies listed on the WSE Main Market.

In DecemberWSE expanded the range of offered instruments by introducing leveraged barrier certificates.

Royal Bank of Scotland, whose structured bonds were newly listed on WSE on June 17,was the eighth issuer of structured instruments. The value of trading in structured products in amounted to PLN The value of trading in investment certificates in was PLN Since Decemberthe Company operates the poee WSE Energy Market. Power on the poee WSE Energy Market is traded on the Daily and Hourly Electricity Market REK WSE and Electricity Futures Market RTE WSE.

REK WSE trades in electricity for hours, days and blocks of hours in the nearest four available days of supply. RTE WSE trades in futures for supply of electric power in blocks of hours for weekly, monthly, quarterly or annual periods.

The poee platform had 30 trading participants at December 31, The turnover in the period from January 1 to December 31, was respectively: WSE is implementing a project aiming to consolidate operators of trading markets in electric power and related products in order to concentrate all trading within the Group.

On November 8,WSE signed an agreement concerning the acquisition of Trading offered by the Group concerns the following instruments: Stock market The Warsaw Stock Exchange is the biggest equities trading market in the Region in terms of turnover value.

FESE 1 Austria, Bulgaria, Czech Republic, Poland, Romania, Slovenia, Slovakia, Hungary.

Turnover on WSE Main Market. WSE, FESE 1 Velocity ratio of trading in shares calculated as the average of FESE monthly data. Euronext Liffe 97, 3. NASDAQ OMX Nordic 37, 4. Borsa Italiana 9, 6. BME Spanish Exchanges 8, 7.

Athens Exchange 2, 9. CEESEG — Budapest 1, CEESEG — Vienna Bucharest Stock Exchange 54 CEESEG — Prague 1.

Buy and Hold This Dividend Stock Forever

FESE, figures concerning Borsa Italiana from the exchange website. Number of structured products, investment certificates, ETFs and warrants listed on WSE.

Value of trading in structured products, investment certificates, ETFs and warrants PLN million, including block trades. Strategy Business lines Listing Trading Sale of market information Key events of WSE Group International activities.

To our stakeholders Letter from the Chairman of the Exchange Supervisory Board Composition of the Exchange Supervisory Board Letter from the President of the WSE Management Board Meet the Management Corporate governance Activities Strategy Business lines WSE Group International activities Financials Financial Statement Interactive data Download center.