Stock options delta gamma theta vegas

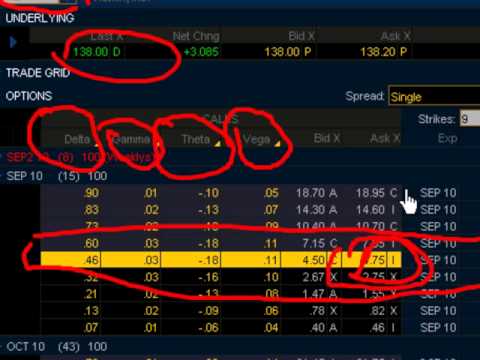

Option greeks measure the options sensitivity to various risk components inherent to the price of an option. These measure include the speed of the underlying securities price movement, interest rate movement, time decay of an option, and volatility. Delta and Gamma measure the options sensitivity to the speed of price changes in the underlying security, Rho measures the options interest rate sensitivity, Theta measures the change in the options price due to a change in the time left till expiration on the option, and Vega measures the change in the options price due to changes in the options historical volatility.

Delta measures the rate of change in the option price over the rate of change in the price of the underlying security. Therefore, we can say that delta measures the speed of the option price movement relative to a single point move in the underlying security.

Option trading delta gamma theta vega

Long calls and naked puts have positive delta while short calls and long puts have negative delta. The closer the delta is to 1 or -1, the greater response in the price of the option when the price of the underlying changes. The examples above assumed that nothing else changed; however, in reality, changes in vega, theta, and rho can impact delta.

If an option is in the money, the delta for a call will approach 1 while the delta of a put will approach At the money ATM options will be near. Also remember, as the option comes closer to expiration, especially within 30 days, the delta curve becomes steeper; basically, the option becomes more sensitive to price movement in the underlying.

Delta neutral trading, also known as "hedge" trading is a method of trading where the total position delta is 0. The idea is to hedge your position by slowing your position speed down. Delta neutral trading is used by many traders to make profitable adjustments on their trade as the price of the security moves up and down. This can be done by making adjustments to the profitable side of your trade. Let's create a simple example of a delta neutral trade. We would need to either buy 2 at the money puts OR sell 2 at the money calls OR buy 1 at the money put and sell 1 at the money call.

Either scenario would get you to delta neutral. Remember, delta neutral does NOT mean that you have set up a risk free position, it means that you have slowed down the speed of the percentage changes of your position. The delta of a stock relies on the price of the stock in relation to the strike price of the option.

Therefore, when the stock price changes, so does the delta. This is where gamma becomes relevant. Gamma is an estimation of the change in delta for a 1 point move in a stock and can be thought of as the second derivative of delta. A large gamma value indicates that delta will shift strongly as the underlying security moves up and down. A long call and long put will have positive gamma while the short counterparts will always be negative. A positive gamma refers to the idea that the delta of a long will become higher, or closer to 1, as the underlying security moves higher.

The long put gamma will also move closer to -1 as the underlying security continues to move lower. The opposite can be said for short calls and short puts. Gamma reaches its highest value when a stock is trading at the money or near the money. This value goes lower and lower as the security moves further out of the money or further in the money.

This makes logical sense as the option price has the highest probability of moving from being OTM to ITM or ITM to OTM. Theta represents the measure for time decay of an option. Remember, an option price consists of intrinsic value and time premium. Theta measures the decay in time premium as every day passes until options expiration.

Not Found

Therefore, we can say that the theta for a long call or put will be negative while the opposite can be said for the short call and put. This is true because when you are long an option, you will lose money in that option every day all else being equal due to the time premium decaying.

However, the time decay in a short option will increase your profits. Theta does not adjust evenly as time goes on. The closer and closer the option is to expiration, the greater the time decay. Theta will accelerate at a higher rate especially when the option has less than 30 days to go. This also makes logical sense since the option has less time to get or stay in a profitable situation.

Additionally, an options theta will be highest when the stock is at the money. Since the stock has basically no intrinsic value, the time value component is the majority of the premium and will fluctuate strongly as expiration approaches. There is a direct correlation between theta and gamma. When an options gamma is high, the theta moves higher as well.

Apple Inc. (AAPL) Option Greeks - cilywadojup.web.fc2.com

When we say higher, it means theta becomes more negative which negatively impacts the time premium for a long option holder. Some options traders will actually play the high theta by selling shorter term options and buying that same strike option with a greater term to maturity at the same time. They are banking on the fact that the longer dated option will have slower time decay than the shorter dated option.

Moving on to the volatility component of an option; we measure the options price sensitivity to volatility using Vega. Vega may also be referred to as kappa by some.

Volatility can be calculated by measuring the standard deviation of the last 30 days of closing prices in the underlying security, commonly known as historical volatility.

Historical volatility is used to determine the fair value of the option; however, options rarely trade in the open market at fair value. We do not want to go into too much detail on this but just know that there are two measurements for volatility and that one is derived from past market data and one is derived from current options premiums themselves.

Higher volatility, or vega, results in higher option prices. This is true because higher volatility gives the option a better chance to expire in the money.

Options exhibit the highest vega when the underlying is at the money and gradually declines as the stock moves ITM or OTM. Our last greek, Rho, measures theoretical option price changes due interest rate shifts.

While this measure of option price sensitivity is the least used, it has more relevant context when applied to higher priced stocks.

Remember that a call option commands a large amount of stock with a relatively small amount of investment. Most times the value of the underlying that the option commands is worth in excess of 10 times the value of the option itself. If you would have to buy the stock, you would need quite a bit more money and the interest expense related that amount is built into a call option premium.

As you can see, as interest rates increase, a call option will increase in value and a put option will decrease in value. It is for this reason that calls have a positive Rho when interest rates rise.

Conversely, if interest rates fall, put premiums will increase while call premiums will decrease. Tim Ord is a technical analyst and expert in the theories of chart analysis using price, volume, and a host of proprietary indicators as a guide TradingSim provides tick by tick data for View Author Related Videos Short Strangles using NSE India Options - Part2 Options Trading: Straddles Part 2 Suze Orman Endorses Covered Calls Related Articles How to Hedge Stock Holdings with Stock Options How to Hedge Stock Holdings with Stock Options Covered Call Puts and Calls Send this article to a friend.

Advertisement Advertisement Global prime forex australia Advertisement Day Trading Day Trading Psychology Day Trading Indicators Day Trading Strategies Day Trading Basics Bonds Bond Basics Bond Glossary Bond Types Credit Option trading bursa malaysia Technical Analysis Basics of Technical Analysis Candlestick Charts Chart Patterns Technical Indicators Fundamental Analysis Earnings Financial Ratios Options Options Basics Options Glossary Options Strategies Stocks Investing Basics Investing Strategies Online Trading Penny Stocks Stock Market Indices Personal Finance Retirement Plans k Annuities Roth IRA Futures Futures Contract Types Futures Basics Forex Forex Basics Forex Agencies issue binary options investor alert Forex Trading Hours Investment Articles Premium Services Free Offers Videos My Stock Market Power Coastal Highway Lewes, Delaware Containing any of the words: Containing none of the words: Only in the category s: Day Trading -Day Creative economy people make money ideas john howkins Psychology -Day Trading Indicators -Day Trading Strategies -Day Trading Basics Bonds -Bond Basics -Bond Glossary -Bond Types -Credit Crisis Technical Analysis -Candlestick Charts -Chart Patterns -Fibonacci -Technical Indicators -Basics of Technical Analysis Fundamental Analysis -Earnings -Financial Ratios Options -Options Basics -Options Glossary -Options Strategies Stocks -Investing Basics -Investing Strategies -Online Trading -Penny Stocks -Stock Market Indices Personal Finance -Retirement Plans k -Annuities -Roth IRA Forex -Forex Basics -Forex Glossary -Forex Trading Hours Futures -Futures Basics -Futures Contract Types Investment Articles blog Image Ad Banking Blog blog Bond Bond ETFs Bonds -Bond Basics --Arbitrage Capital Asset Pricing Model --Bond Math --Bond Price Volatility --Convexity --CUSIP --Duration --Yield Curve -Bond Glossary --Accrued Interest --Basis Points --CPI --Discount Rate --Eurodollar --Fed Funds --Federal Reserve Bank --GDP --Inflation --Interest Rate Swap --LIBOR --Maturity Date --Recession --TED Spread -Bond Types --Asset Backed Securities --Callable Bonds --CDOs --CDs --Commercial Paper --Convertible Bonds --Corporate Bond --Credit Default Swaps --Fixed Income ETFs --High Yield Bonds --I Bonds --MBS --Money Market --Municipal Bonds --Repo --Series EE --Structured Investment Vehicle --Syndicated Bank Loan --Treasury Bills --Treasury Bond --Treasury Inflation Protected Securities --Treasury STRIPS -Credit Crisis --Credit Crisis Conclusion --Deleverage --Mortgage Crisis Brazil ETF Chart Patterns Clean Energy ETF Commodity ETFs Consumer Confidence Corporate Debt Day Trading -Automated Trading -Day Trading Hardware and Software -Day Trading Indicators -Day Trading Journal -Day Trading Money Management -Day Trading Psychology -Day Trading Risk -Day Trading Strategies --Day Trading Breakouts --Momentum Trading -Level II -Scalp Trading -Trading Plan -Trading Risk -Visual Exercise Day Trading Basics derivatives Dogs of the Dow Dogs of the Dow Videos Dow ETF Elliott Wave Videos Emerging Markets ETF Energy ETFs ETF List Financial ETFs Forex -Currency Carry Trade -Forex Basics -Forex Share options tax implications ireland --Base Currency --Cross Rate --Currency Swap --Forex PIP -Forex Trading Hours Fundamental Analysis -Altman Z Score -Asset Allocation -Balance Sheet --Accounts Receivables -Book Forex rynek towarowy -Capital Structure -Cash Conversion Cycle -Cash Flow Statement -Cost reading the tape stock market Capital -Cost of Goods Sold -Current Liabilities -Days Payable Outstanding -Debt to Income Ratio -Deferred Tax Assets -Depreciation -Discounted Cash Flow -Earnings -EPS -Financial Ratios --EBITDA --Leverage Ratios --Liquidity Ratios --PE Ratio --PEG Ratio --Price To Sales Ratio -Income Statement -Inventory Valuation -IRR -Mark to Market -Market Capitalization -Net Present Value -Profit Margins -Retained Earnings -Return on Assets -Return on Equity -Treasury Stock -WACC -Working Capital Futures -Commodity Futures -Emini Futures -Forward Contract -Futures Basics -Futures Contract -Futures Contract Types -Futures Margin Requirements -Futures Trading Pits -Index Futures -Interest Rate Futures -Introduction to Futures -Limit Down Futures -Open Outcry -Spot Price Gold Gold Creative economy people make money ideas john howkins Healthcare ETF history of technical find trend forex trading Income ETF inheritance tax Initial Public Offering insurance Investment Articles IRA liquidity Mutual Funds Non-Farm Payrolls Options -Option Greeks -Options Basics --Implied Volatility -Options Expiration -Options Glossary --Call Option --Options Moneyness --Put Options --Strike Price -Options Strategies --Bull Call Spread --Bull Put Spread --Butterfly Spread --Call Ratio Backspread --Call Ratio Spread --Condor --Covered Calls --Married Puts --Naked Puts --Short Mob wars earning money --Short Strangle --Straddle --Strangle Penny Stocks.

Investing Basics Personal Finance -Adjusted Gross Income -APR -Beneficiary -Bridge Loan -Credit Cards -Education Savings Accounts -FICO Score -HELOC -Joint Tenancy -Life Expectancy -Loan to Value -Mortgage Basics --Adjustable Rate Mortgage --Alt-A --Amortization Table --Balloon Mortgage -Negative Amortization -PMI -Qualified Plans -Required Minimum Distribution -Retirement Plan Loans -Retirement Plans k b --Annuities --Defined Benefit Plan --Defined Benefit Program --Early Withdrawal Penalty Exclusions --Roth k --Roth IRA Roth IRA Contribution Roth IRA Conversion Roth IRA Withdrawal --SEP IRA --Simple IRA --Traditional IRA --Variable Annuities -Secured Credit Card -Truth in Lending -Unemployment Rate Pink Sheets Recharacterization Resources restricted Roth IRA Ordering Rules sharpe ratio Silver ETFs Stock Market Indicies Stock Terms Stocks -ADRs -After Hours Trading -Bear Market -Bear Raid -Berkshire Hathaway Holdings -Blue Chip Stocks -Boiler Room -Bottom Up Investing -Bull Market -Buy and Hold -Buy Back -Buy Limit Order -Buyout -Capital Gains -Cash Trading -Closing Bell -Common Stock -Direct Access Broker -Dividends -Dollar Cost Average -ECNs -ETFs -Green Investing -Insider Trading -Investing Basics -Investing for Dummies -Investing Strategies -Jesse Livermore -Leveraged Buyout -Leveraged ETFs -Limit Order -Margin Trading --Buying Power -Market Maker -Online Trading -Opening Bell stock options delta gamma theta vegas Stocks -Preferred Stock -Pullback -REITS -Rogue Trader -Secondary Market -Shareholders Equity -Short Selling -Short Squeeze -Stock Market Indices -Stock Splits -Stock Tips -Trailing Stops -Wall of Worry Tax Taxes Technical Analysis -Candlestick --Dark Cloud Cover -Chart Patterns --Ascending Triangle --Bar Chart --Bear Trap --Breakdown --Cup and Handle --Dead Cat Bounce --Descending Triangle --Double Bottom --Flag --Gap Breakaway Gap --Pennant --Symmetrical Triangle --Wedge -Cycles --Cyclical Stocks -Fibonacci -Point and Figure Charts -Renko Charts -Technical Indicators --Absolute Breadth Index --Advance Decline Line --ADX --Andrews Pitchfork --Bollinger Bands --Bull Bear Ratio --CCI --Exponential Us stock market crashes on black tuesday Average --MACD --Money Flow Index --Moving Average --On Balance Volume --Parabolic SAR --RSI --Sentiment Indicators --Simple Moving Average --Slow Stochastic --Volume Analysis --Zig Zag TIPS ETFs Total Asset Turnover Trading Courses Trading Strategies trends Triple Leveraged ETF Liquidation stock warehouse uk Video -Bond Videos --Bond Basics Videos Arbitrage Capital Asset Pricing Model Videos Bond Math Daily forex rates ghana Bond Price Volatility Videos Convexity Videos CUSIP Videos Duration Videos Yield Curve Videos --Bond Definition Videos --Bond Glossary Videos Basis Point Videos CPI Videos Discount Rate Videos Eurodollar Videos Fed Funds Videos Federal Reserve Bank Videos GDP Videos Inflation Videos Interest Rate Swap Videos LIBOR Videos Maturity Date Videos Recession Videos TED Spread Videos --Bond Types Videos Asset Backed Securities Videos Callable Bond Videos CD Videos CDO Videos Commercial Paper Videos Convertible Bond Videos Corporate Bond Videos Credit Default Swap Videos Fixed Income ETF Videos High Yield Bond Videos I Bond Videos MBS Videos Money Market Videos Municipal Bond Videos Repo Videos Series EE Bond Videos Structured Investment Vehicles Videos Syndicated Bank Loan Videos Treasury Bills Videos Treasury Bond Videos Treasury Inflation Protected Securities Videos Treasury STRIPS Videos --Credit Crisis Videos Credit Crisis Conclusion Videos Deleveraging Videos -Day Trading Videos --Automated Trading Videos --Day Trading Hardware Videos --Day Trading Journal Videos --Day Trading Money Management Videos --Day Trading Risk Videos --Day Trading Strategies Videos Day Trading Breakouts Videos Momentum Trading Videos --Level II Videos --Scalp Trading Videos --Trading Plan Videos -Forex Videos --Cross Rate Videos --Currency Swap Videos --Forex Basics Videos Base Currency Videos --Forex Trading Hours Videos -Forex Videos --Currency Carry Trade Videos -Fundamental Analysis Videos --Altman Z Score Videos --Asset Allocation Videos --Balance Sheet Videos Accounts Receivables Videos --Book Value Videos --Capital Structure Videos --Cash Flow Statement Videos --Cost of Capital Videos --Cost of Goods Sold Videos --Current Liabilities Videos --Days Payable Outstanding Videos --Debt to Income Ratio Videos --Deferred Tax Assets Videos --Depreciation Videos --Discounted Cash Flow Videos --EPS Videos --Financial Ratios --Financial Ratios Videos EBITDA Videos Leverage Ratio Videos Liquidity Ratio Videos PE Ratio Videos PEG Ratio Videos Price to Sales Videos --Income Statement Videos --Inventory Valuation Videos --IRR Videos --Mark to Market Videos --Market Capitalization Videos --Net Present Value Videos --Profit Margin Videos --Retained Earnings Videos --Return on Assets Videos --Return on Equity Videos --WACC Videos --Working Capital Videos -Futures Videos --Commodity Futures Videos --Emini Futures Videos --Forward Contract Videos --Futures Contract Videos --Futures Margin Requirement Videos --Index Futures Videos --Introduction to Futures Videos --Limit Down Futures Videos --Open Outcry Videos --Spot Price Videos -Mutual Funds Videos -Options Videos --Option Greeks Videos --Options Basics Videos Implied Volatility Videos --Options Expiration Videos --Options Glossary Videos Call Option Videos Options Moneyness Videos Put Option Videos Strike Price Videos --Options Strategies Videos Bull Call Spread Video Bull Put Spread Videos Butterfly Spread Videos Call Ratio Backspread Videos Call Ratio Spread Videos Condor Videos Covered Call Videos Married Puts Videos Naked Puts Videos Short Straddle Videos Short Strangle Videos Straddle Videos Strangle Videos -Personal Finance Videos --Adjusted Gross Income Videos --APR Videos --Beneficiary Videos --Bridge Loan Videos --Education Savings Account Videos --FICO Score Videos --Life Expectancy Videos --Loan to Value Videos --Mortgage Videos Adjustable Rate Mortgage Videos Alt-A Videos Amortization Table Videos Balloon Mortgage Videos HELOC Videos Mortgage Crisis Videos Negative Amortization Videos --PMI Videos --Qualified Plan Videos --Required Minimum Distribution Videos --Retirement Plan Loan Videos --Retirement Plan Type Videos K Videos Annuity Videos Defined Benefit Plan Videos Early Withdrawal Penalty Exclusion Videos Roth k Videos Roth IRA Videos SEP IRA Videos Simple IRA Videos Traditional IRA Videos Variable Annuity Videos --Secured Credit Card Videos --Truth In Lending Videos --Unemployment Rate Videos -Stocks Videos --ADR Videos --After Hours Trading Videos --Bear Market Videos --Bear Raid Videos --Berkshire Hathaway Holdings Videos --Blue Chip Stocks Videos --Boiler Room Videos --Bottom Up Investing Videos --Bull Market Videos --Buy and Hold Videos --Buy Back Videos --Buy Limit Order Videos --Buyout Videos --Capital Gains Videos --Cash Trading Videos --Closing Bell Videos --Common Stock Videos --Direct Access Broker Videos --Dividend Videos --Dollar Cost Average Videos --ETF Videos --Green Investing Videos --Insider Trading Videos --Investing For Dummies Videos --Jesse Livermore Videos --Leveraged Buyout Videos --Leveraged ETFs Videos --Limit Order Videos --Margin Trading Videos Buying Power Videos --Market Maker Videos --Opening Bell Videos --Penny Stocks Videos --Preferred Stock Videos --Pullback Videos --REIT Videos --Rogue Trader Videos --Secondary Market Videos --Short Selling Videos --Short Squeeze Videos --Stock Splits Videos --Stock Tips Videos --Trailing Stops Videos --Wall of Worry Videos -Technical Analysis Videos --Candlesticks Videos Dark Cloud Cover Videos --Chart Patterns Videos Ascending Triangle Videos Bar Chart Videos Breakdown Videos Cup and Handle Videos Dead Cat Bounce Videos Descending Triangle Videos Double Bottom Videos Flag Videos Gap Videos Pennant Videos Point and Figure Charts Videos Symmetrical Triangle Videos Wedge Videos --Cycles Videos Cyclical Stocks Videos --Fibonacci Videos --Renko Charts Videos --Technical Indicators Videos ADX Videos Andrews Pitchfork Video Bollinger Bands Videos Bull Bear Ratio Videos CCI Videos Exponential Moving Average Videos MACD Videos Money Flow Index Videos Moving Average Videos On Balance Volume Videos Parabolic SAR Videos RSI Videos Simple Moving Average Videos Slow Stochastic Videos Volume Analysis Videos Zig Zag Videos -World Markets Videos --Bombay Stock Exchange Videos --BSE Sensex Videos --Money Supply Videos World Markets -Bombay Stock Exchange -BSE Sensex -Money Supply.

Only of the type s: Home Videos Advertise Contact. Day Trading Day Trading Psychology Day Trading Indicators Day Trading Strategies Day Trading Basics Bonds Bond Basics Bond Glossary Bond Types Credit Crisis Technical Analysis Basics of Technical Analysis Candlestick Charts Chart Patterns Technical Indicators Fundamental Analysis Earnings Financial Ratios Options Options Basics Options Glossary Options Strategies Stocks Investing Basics Investing Strategies Online Trading Penny Stocks Stock Market Indices Personal Finance Retirement Plans k Annuities Roth IRA Premium Services Free Offers.

Options Basics Options Glossary Options Strategies. Facebook Twitter LinkedIn Email. Overview of Option Greeks Option greeks measure the options sensitivity to various risk components inherent to the price of an option. Delta Basics Delta measures the rate of change in the option price over the rate of change in the price of the underlying security.

Delta Ranges for Calls and Puts If an option is in the money, the delta for a call will approach 1 while the delta of a put will approach Delta Neutral Trading Delta neutral trading, also known as "hedge" trading is a method of trading where the total position delta is 0. Gamma Basics The delta of a stock relies on the price of the stock in relation to the strike price of the option.

Greeks (finance) - Wikipedia

Theta Basics Theta represents the measure for time decay of an option. Relationship between Theta and Gamma There is a direct correlation between theta and gamma. Vega Basics Moving on to the volatility component of an option; we measure the options price sensitivity to volatility using Vega. Rho Basics Our last greek, Rho, measures theoretical option price changes due interest rate shifts.

Short Strangles using NSE India Options - Part2. Suze Orman Endorses Covered Calls. How to Hedge Stock Holdings with Stock Options. Send this article to a friend. Day Trading Day Trading Psychology Day Trading Indicators Day Trading Strategies Day Trading Basics. Bonds Bond Basics Bond Glossary Bond Types Credit Crisis.

Technical Analysis Basics of Technical Analysis Candlestick Charts Chart Patterns Technical Indicators. Fundamental Analysis Earnings Financial Ratios.

Options Options Basics Options Glossary Options Strategies. Stocks Investing Basics Investing Strategies Online Trading Penny Stocks Stock Market Indices. Personal Finance Retirement Plans k Annuities Roth IRA. Futures Futures Contract Types Futures Basics. Forex Forex Basics Forex Glossary Forex Trading Hours.

Investment Articles Premium Services Free Offers Videos. My Stock Market Power Coastal Highway Lewes, Delaware