Weak form of market efficiency evidence from nepalese stock market

Silver Certificate. Risk Management - cilywadojup.web.fc2.come

Joshi, Nayan and K. C, Fatta Bahadur The Nepalese stock market: Efficiency and calendar anomalies. Occasiona Paper of Nepal Rastra Bank , Vol. After describing the various forms of efficiency and calendar anomalies observed in many developed and emerging markets according to the existing literature, the present study examines this phenomenon empirically in the Nepalese stock market for daily data of Nepal Stock Exchange Index from February 1, to December 31, covering approximately ten years.

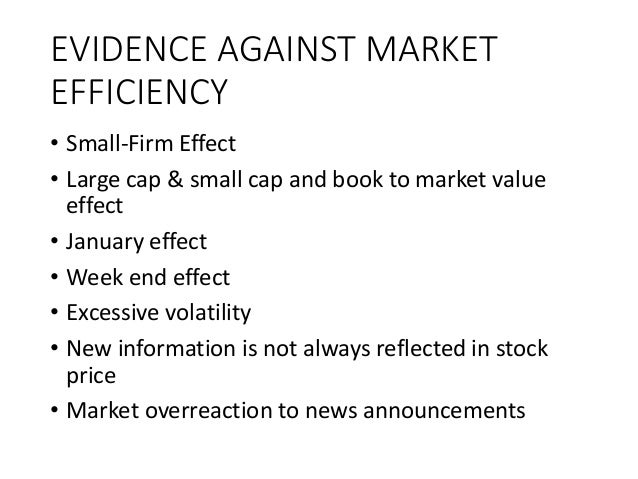

Using regression model with dummies, we find persistent evidence of day-of-the-week anomaly but disappearing holiday effect, turn-of-the-month effect and time-of-the-month effect. We also document no evidence of month-of-the-year anomaly and half-month effect. Our result for the month-of-the-year anomaly is consistent to the finding observed for the Jordanian stock market and that for the day-of-the-week anomaly to the Greek stock market.

In addition, our finding regarding half-month effect is consistent with the US market. For the rest, we find inconsistent results with that in the international markets. Our results indicate that the Nepalese stock market is not efficient in weak form with regard to the day-of-the-week anomaly but weakly efficient with respect to the other anomalies. Journal of International Money and Finance.

An Application To Contrarian Investment Strategies". Journal of Financial Economics, 38 1: Journal of Financial Economics 9, Journal of Finance, 39 March: Evidence from Istanbul Stock Exchange? Effects of low share price, transactions costs, and bid-ask bias.

The Nepalese stock market: Efficiency and calendar anomalies - Munich Personal RePEc Archive

Journal of Finance An Application to the Size Effect. Tax-Loss Selling versus Information Explanations.

The Different Types of Market Efficiency: Weak Form, Semi-Strong Form and Strong FormJournal of Financial Economics, 12 June: In Taylor, Kingsman ,S. G and Guimares ,R.

Journal of Financial and QuantitativeAnalysis 28, June ; 10 3: Financial Analysts Journal, 29 6: Working Paper, National University of Ireland. Another Look at the Day-of-the-Week Effect. Hebrew University of Jerusalem. Journal of Business 54, Journal of Financial and Quantitative Analysis, 35 3.

Federal Reserve Bank of Atlanta. Dow Jones Irwin, Homewood, Ill.

Weak Form of Market Efficiency: Evidence from Nepalese Stock Market by Surya Bahadur G. C. :: SSRN

Journal of Portfolio Management. Journal of International Financial Management and Accounting, 2: Evidence from Foreign Countries. The Journal of Finance, XLV 5: Working Paper, University of Washington. Nominal Stock Return Seasonalities: Paper Presented at the 10th Pacific-Basin Finance, Economics and Accounting Conference, Singapore.

Financial Analysts Journal, 16, 74— Sunway College Journal 1: Hong Kong Journal of Business Management 5, Journal of Finance, Journal of Portfolio Management, 9: Journal of Financial Economics, 3: De Economists, 15 3: Japan and the World Economy. Home Browse Search FAQ About Help.

All papers reproduced by permission. Reproduction and distribution subject to the approval of the copyright owners. MPRA is a RePEc service hosted by the Munich University Library in Germany. Market efficiency, seasonal anomalies, tax-loss selling hypothesis, institutional window dressing hypothesis, information hypothesis.

Journal of Business 50 2: