What happens to the money supply when banks make loans

The money is removed when the loan principal is repaid.

The actual point in the loan this occurs depends on the loan terms. For a typical compound interest rate loan, this means a small portion of the principal is repaid every month, and a matching liability deposit money in the customers account is removed. For an interest only loan, this occurs at the end of the loan - assuming all the principal is repaid then.

Interest payments essentially circulate through the monetary system. They're deducted from the customer's account, recognised as income by the bank, and then paid out as some form of expense, e. They may also be moved into an internal account to provide required loss provisions on loans.

Loan defaults are also an expense, and this is the achilles heel of the banking system. If defaults on loans exceed the bank's loss provisions and profits from interest, then the bank will have to write off against its capital - and this interferes with the regulatory controls on lending, causing the money supply to shrink.

In practice, central bank or government intervention is inevitable if this occurs. As far as the relationship of principal to the money supply. Essentially the banking system relies on new lending always being sufficient to replace the money being removed.

In most banking systems, new lending is typically in excess of loan repayment, and so we see the money supply more or less continuously expanding. I'll explain this by way of an example: If I take out a loan to buy a car, every time I make a repayment my current account spendable money is reduced, as is the outstanding balance on my loan account with the bank - so what was spendable money sitting in my current account effectively disappears into thin air.

However, when a bank writes off an unpaid loan it has made to one its customers, it doesn't reduce its own cash reserves, but instead reduces the bookkeeping profit sitting in its Profit and Loss Account - no 'spendable' bank account balances anywhere are reduced by doing this! The net profit of a bank only becomes 'spendable' money when bookkeeping entries are made to transfer and credit it to customers' and its own? I appreciate the order of write-off is loss reserve, profits and then capital - but reducing these balances when writing off loans does NOT 'destroy' spendable money in accounting terms.

Therefore, one cannot cancel the other out. When the a loan is written-off, the accounting entries are: Doing this does NOT diminish the quantity of 'money' in existence in the bank's accounts. From the bank's perspective, and in accounting terms, only its customers can 'destroy' money by paying-off their loans and reducing the balances on their bank accounts.

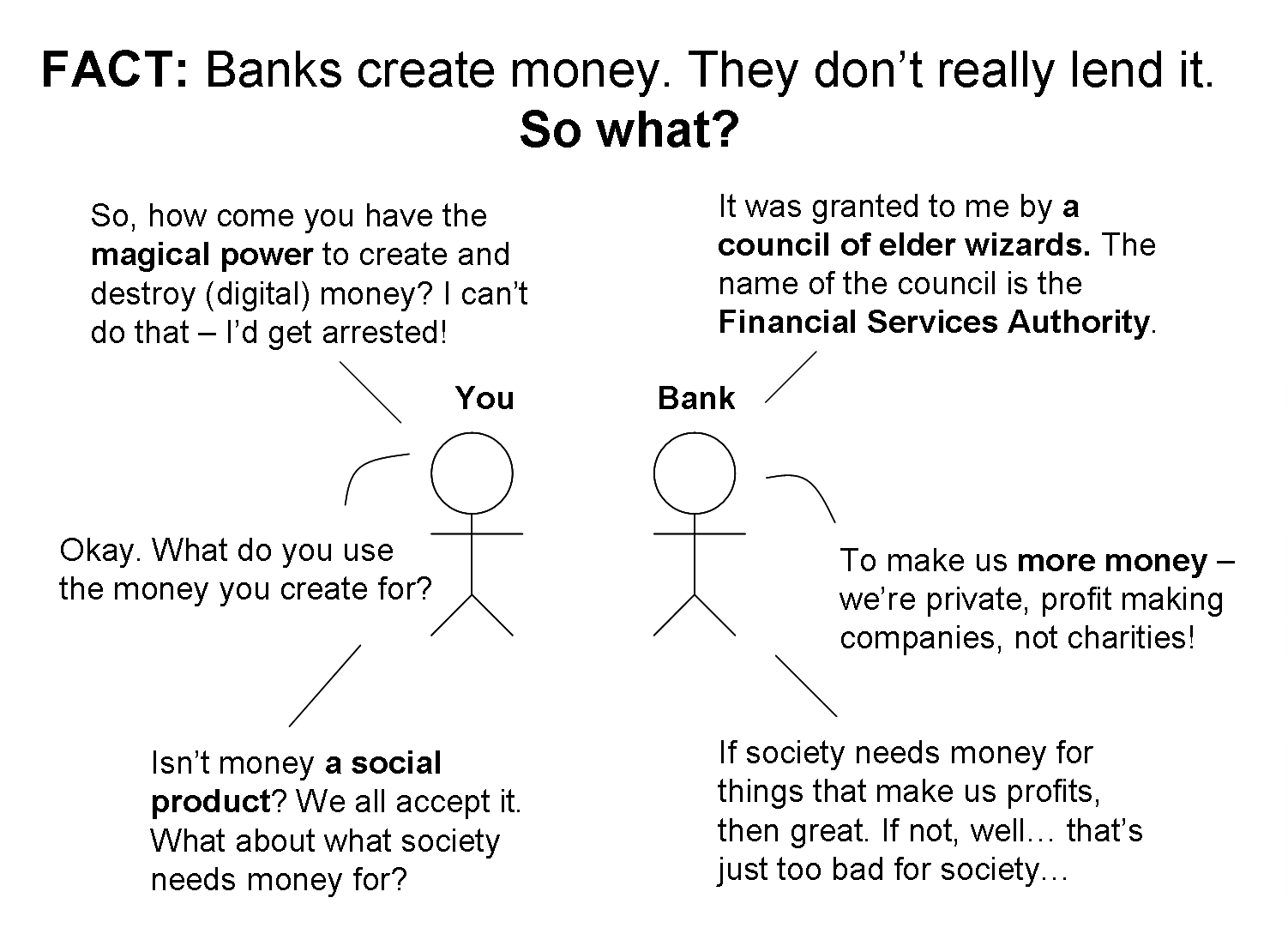

It is impossible for the bank to 'destroy' money it has created itself through the act of lending. The creation of money occurs when the bank loans out any amount not backed by its reserves to a borrower.

The borrower's debt is the excess money. As the borrower pays back the money to the bank, the supply of money in the system contracts. This is of course until the bank lends further against its reserves to another borrower. Interest payments are akin to money received for a product, that is the loan, and management of the risk held by the bank in lending money. Interest only loans pay for the service of holding the money you and the bank created by borrowing from the bank.

Then like all loans, once the payment is made, the supply of money you the borrower created is shrunk. The bank however has made money on the interest. Over time supply and demand for loans and lending expand and contract the money supply. This coupled with the reserve rate requirements dictated by central banks dictates the supply of money in the system.

AP Macroeconomics Module 27 Key Terms and Study Questions Flashcards | Quizlet

By posting your answer, you agree to the privacy policy and terms of service. By subscribing, you agree to the privacy policy and terms of service. Sign up or log in to customize your list.

Stack Exchange Inbox Reputation and Badges. Questions Tags Users Badges Unanswered. Economics Stack Exchange is a question and answer site for professional and academic economists and analysts.

How Banks Create Money - Positive Money

Join them; it only takes a minute: Here's how it works: Anybody can ask a question Anybody can answer The best answers are voted up and rise to the top. How does the money supply behave when bank loans are repaid? FooBar 6, 1 13 AndyFlip 23 1 6.

Not mentioned in any of the replies was the fact that when the borrower fails to pay back the loan, the bank takes ownership, though not happily, of the property the money was created and lent to buy. A house for example. In effect, the house is now a bank asset and offsets, partially, the total amount of money lent. Lumi 2, 9 When the principal is reduced, the corresponding deposit is removed from circulation, when a new loan is made, then a corresponding deposit is added to circulation.

So the money itself doesn't remain in circulation during this process - it's being continuously removed and re-added. Will it deplete the money cycle by USD Also to add up to above, its obvious that the USD 27 earned as an interest on the loan by the bank will add up to the profits of the bank but what about the USD which the bank received back in form of principal repayment from the borrower?

How will that USD be used up by the respective bank, does it adds up to banks assets, or to the pool of funds of the bank so that they could utilize the same or could lend that same amount of USD ahead once again? It depletes it by - the amount of the principal. The double entry book keeping operations they use are [debit loan , credit account ] to make the loan, and [credit loan , debit account ] to repay the principal.

If the bank is within its regulatory constraints then it can issue a new loan, and recreates the deposit. Principal doesn't count as profit at all, but if the loan isn't repaid, then profits have to be used to write-off the loan.

Alex Marshall 1 1.

The write-off order is against loss provisions, then profits, and finally capital. Banks are typically required to maintain a certain percentage of loss provisions vs. If they write off against profits, then that money isn't recognised as income - again an effective drop, and if they have to hit capital, then the regulatory controls become problematic as they can't make a new loan - again, reducing the effective money supply.

I agree there is a very interesting issue lurking behind all this, in whether things like loss provisions and interest income before its recognised, should be counted as part of the money supply or not. I beg to differ. It's not a question of just whether or not it's on the debit side of the ledger.

Show me a money supply definition, M1, etc. Now I completely agree at the D. Sign up or log in StackExchange. Sign up using Facebook.

Sign up using Email and Password.

Post as a guest Name. In it, you'll get: The week's top questions and answers Important community announcements Questions that need answers. Economics Stack Exchange works best with JavaScript enabled.

MathOverflow Mathematics Cross Validated stats Theoretical Computer Science Physics Chemistry Biology Computer Science Philosophy more 3. Meta Stack Exchange Stack Apps Area 51 Stack Overflow Talent.