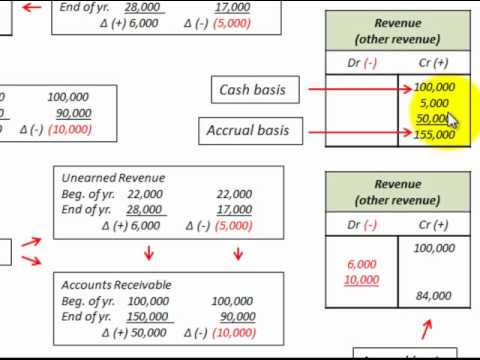

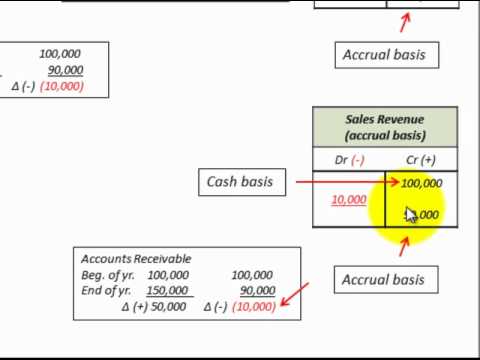

Convert earnings from cash to accrual basis

Cash Flow Statement - Indirect Method - Example, Format and Advantages - cilywadojup.web.fc2.com

Posted by Kasey Bayne on April 15, at 7: If you're a freelancer, sole proprietor, or small business owner who's just getting started with accounting, you may not know the difference between the cash basis of accounting the "cash method" and the accrual basis of accounting the "accrual method".

Maybe you weren't even aware that there were two different ways to track your company's accounting. We're about to look at a quick rundown of these two methods, including when you would be likely to use each of them, and how to switch from the cash basis to the accrual basis. This switch is a step that you may find yourself needing to make as your business grows and you want to get a more accurate picture of your company's financial situation.

How you track your income and expenses will depend on which accounting method you choose, cash or accrual.

Under the cash basis of accounting, all of your transactions - whether it's a payment from a customer for goods or services sold, or an expense you're paying for, like purchasing raw materials or office supplies - are recorded when the cash for that transaction is received or paid out. When you're first starting out and your business is still relatively small, it may be easier to follow the cash method to do your bookkeeping, especially if you don't have anyone with accounting knowledge to help you out.

Although the cash method may be simpler to start, most small businesses will likely want to switch to the accrual basis of accounting as their business grows, or if their books are being audited in preparation for selling the business or applying for a financial product or service such as a loan. Firstly, there are certain expenses you will need to add, namely: Accrued expenses are those you have not paid for yet, but for which you've already received some kind of benefit this includes any materials you've already received and haven't paid the supplier for, and wages earned by employees that have not yet been paid to them.

Prepaid expenses are any cash payments you've made related to your assets which you haven't used up yet like a rent deposit. Any prepaid expenses occurring in the period being switched to the accrual method can be moved to an asset account. You will also need to add accounts receivable , which are any sales you've made for which you have not yet received payment from the customer. Learn more about accounts receivable and accounts payable.

Now it's time to subtract certain payments: Cash payments refers to any cash paid out for expenses that should have been recorded in the previous accounting period. These expenses are incorporated into this earlier period, meaning your beginning retained earnings balance for the current period is reduced. When sales were initiated in a previous period and you received cash cash receipts in the current period, you will need to reverse the sale in the current period and instead record it as a receivable in the prior period when it was actually initiated.

As with cash payments, this means adjusting your beginning retained earnings for the current period. While this prepayment would have been noted as a sale under the cash method, under the accrual method it should be recorded as a short-term liability until the goods are shipped or the service is provided to the customer. If you're using accounting software that's set up for the cash method, it may not be easy or even possible to make the switch to the accrual method with the same software.

Always talk to an accounting professional or tax pro when considering systematic moves like this. You may need to go through the transactions occurring in the period you're switching over by way of manual journal entries. This can be a long and arduous task, as you don't want to miss any transactions if you want the conversion to be accurate and complete.

While you are able to do your bookkeeping with the cash method in Kashoo , and even generate reports on the cash basis, most small business owners choose to use it with the accrual method. If you're currently using the cash method and have questions about moving over to accrual, we'd love to hear from you!

Reach out to us anytime at answers kashoo. And remember, nothing int this or any Kashoo blog post should be considered legal or professional accounting advice!

You'll be glad you did. Pricing Features Reviews Blog Try It FREE. Kash is King - The Official Kashoo Blog.

Accrual Basis To Cash Basis Conversion (Net Income Adjusted, Indirect Cash Flow Method)Accounting, business and technology insights for those who are blazing their own trail to success. Switching From Cash Basis to Accrual Basis Accounting Posted by Kasey Bayne on April 15, at 7: Cash Basis vs Accrual Basis How you track your income and expenses will depend on which accounting method you choose, cash or accrual.

Access to this page has been denied.

Accrual Cloud Accounting If you're using accounting software that's set up for the cash method, it may not be easy or even possible to make the switch to the accrual method with the same software. Topics Accounting Accounting Software 12 Announcements 26 Bookkeeping 34 Business Insights Start using Kashoo right now.

By clicking "Start Your Free Trial" you agree to the Terms of Service and Privacy Policy.

How to convert accrual basis to cash basis accounting — AccountingTools

Are You An Accountant? Kashoo U Blog Join a Free Workshop Get Support. About Us Press Room Careers Privacy Policy Terms of Service.