How to place a forex order

Join the NASDAQ Community today and get free, instant access to portfolios, stock ratings, real-time alerts, and more! When you place orders with a forex broker, it is extremely important that you know how to place them appropriately. Orders should be placed according to how you are going to trade - that is, how you intend to enter and exit the market. Improper order placement can skew your entry and exit points.

How To Place Orders With A Forex Broker

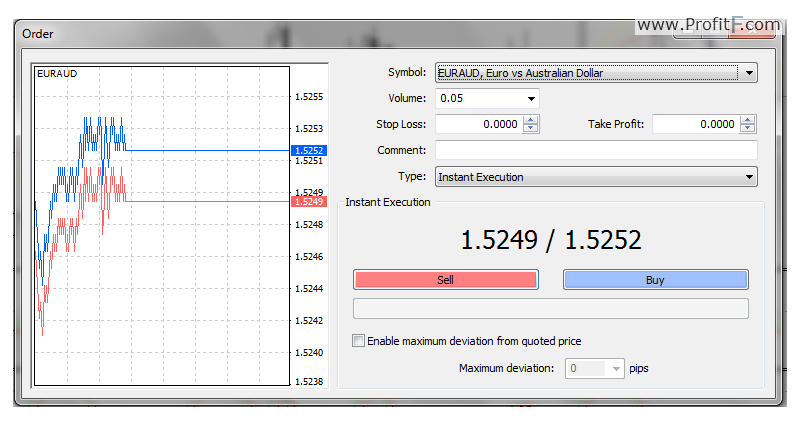

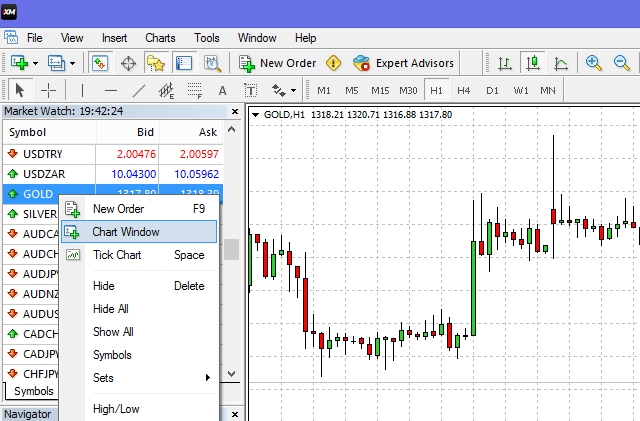

In this article, we'll cover some of the most common forex order types. Market Order This is the most common type of order.

How to Trade Forex: 12 Steps (with Pictures) - wikiHow

A market order is used when you want to execute an order immediately at the market price, which is either the displayed bid or ask price on your screen. You may use the market order to enter a new position buy or sell or to exit an existing position buy or sell. Stop Order A stop order is an order that becomes a market order only once a specified price is reached.

How To Set Pending Orders (DETAILED) - So Darn Easy ForexIt can be used to enter a new position or to exit an existing one. A buy-stop order is an instruction to buy a currency pair at the market price once the market reaches your specified price or higher, which is higher than the current market price.

A sell-stop order is an instruction to sell the currency pair at the market price once the market reaches your specified price or lower, which is lower than the current market price. To trade this opinion, you can place a stop-buy order a few pips above the resistance level so that you can trade the potential upside breakout. If the price later reaches or surpasses your specified price, this will open your long position.

An entry stop order can also be used if you want to trade a downside breakout. Place a stop-sell order a few pips below the support level so that when the price reaches your specified price or goes below it, your short position will be opened. Everyone has losses from time to time, but what really affects the bottom line is the size of your losses. Before you even enter a trade, you should already have an idea of where you are going to exit your position should the market turn against it.

One of the most effective ways of limiting your losses is through a pre-determined stop order, which is commonly referred to as a stop-loss. In order to avoid the possibility of chalking up uncontrolled losses, you can place a stop-sell order at a certain price so that your position will automatically be closed out when that price is reached.

Once your trade becomes profitable, you may shift your stop-loss order in the profitable direction so as to protect some of your profit.

For a long position that has become very profitable, you may move your stop-sell order from the loss to the profit zone to safeguard against the chance of realizing a loss in forex automated easy your trade does not reach your specified profit objective, and the market turns against your trade. Similarly, for a short position that has become very profitable, you may move your stop-buy order from loss to the profit zone in order to protect your gain.

Limit Order A limit order is m3 forex navigator software when you are only willing to enter a new position or to exit a current position at a specific price or better.

The order will only be filled if the market trades at that price or better.

A limit-buy order is an instruction to buy the currency pair at the market price once the market reaches your specified price or lower, and is lower than the current market price.

A limit-sell order is an instruction to sell the currency pair at the market price once the market reaches your specified price or higher, and it is higher than the current market price. You fade a breakout when you don't expect the currency price to break successfully past a resistance or a support level. In other words, you expect that the currency price will bounce off the resistance to go lower, or bounce off the support to go higher.

You can then place a limit-sell order a few pips below that resistance level so that your short order will be filled when the market moves up to that specified price or higher. Besides using the limit order to go short near how to get your money back from a scammer on ebay resistance, you can also use this order to go long near a support level.

In this case, you can place a limit-buy order a few pips above that support level so that your long order will be filled when the market moves down to that specified price or lower. Before placing your trade, you should already have an idea of where you want to take profits should the trade go your way. A limit order allows you to exit the market at your pre-set profit objective. If you long a currency pair, you will use the limit-sell order to place your profit objective.

If you go short, the limit-buy order should be used to place your profit objective. Note that these orders will only accept prices in the profitable zone.

Execute the Correct Orders How to place a forex order a firm understanding of the different types of orders will enable you to use the right tools to achieve your intentions - how you want to enter the market trade or fadeand how you are going to exit the market profit and loss. While there may be other types of orders, market, stop and limit orders are the most common of them all. Be comfortable using them because improper execution of orders can cost you money.

Mechanics of Forex Trading (learn forex online)

Grace Cheng is a forex trader, creator of the PowerFX Course and author of "7 Winning Strategies for Trading Forex"Harriman House. This revealing book explains how traders can use various market conditions to their advantage by tailoring a strategy to suit each one.

The book is a perfect complement to the PowerFX Course. The PowerFX Course, designed for both new and current traders, teaches tools and trading approaches that combine technicals, fundamentals and the psychology of trading forex. It also includes Grace's proprietary tips and tricks. Answer financial questions posed by the NASDAQ Answers Community:.

Do you have a question about forex trading? Ask it here and get answers from the NASDAQ Answers Community:. Enter up to 25 symbols separated by commas or spaces in the text box below. These symbols will be available during your session for use on applicable pages.

You have selected to change your default setting for the Quote Search. This will now be your default target page; unless you change your configuration again, or you delete your cookies. Are you sure you want to change your settings? Please disable your ad blocker or update your settings to ensure that javascript and cookies are enabledso that we can continue to provide you with the first-rate market news and data you've come to expect from us.

Company News Market Headlines Market Stream. Economic Calendar Business Video Technology News.

How to Invest Investing Basics Broker Comparison Glossary Stocks Mutual Funds. ETFs Forex Forex Broker Comparison. Wealth Management Options Bonds. Retirement Real Estate Banking Insurance. Saving Money Taxes Investments Small Business.

Stock Ratings My Ratings Smart Portfolio Overview My Holdings My Portfolio Analysis Crowd Insights My Performance Customize Your Experience. Join Today Already a member? Place Forex Orders Properly provided by: Have a Question About Forex? Ask it here and get answers from the NASDAQ Answers Community: CLOSE X Edit Favorites Enter up to 25 symbols separated by commas or spaces in the text box below. CLOSE X Customize your NASDAQ. CLOSE X Please confirm your selection: Why Alphabet's Waymo Is Leading in Self-Driving Cars Alphabet began its self-driving experiment as early as Update Clear List CLOSE X Customize your NASDAQ.

If, at any time, you are interested in reverting to our default settings, please select Default Setting above. If you have any questions or encounter any issues in changing your default settings, please email isfeedback nasdaq.