Foreign exchange rates ato 2013

This information may not apply to the current year. Check the content carefully to ensure it is applicable to your circumstances. The Foreign income return form guide contains an explanation of measures relating to the taxation of foreign income derived by, or attributed to, Australian residents.

In relation to these measures, this guide deals only with aspects of ongoing relevance: The chapters in this guide are:. Summary sheets at the end of this guide provide a quick reference to assist you in determining if the measures apply to you, and to what extent.

Where necessary, worksheets have also been provided to help you work out your tax liability. Although the guide is detailed, it may not cover all the qualifications and conditions contained in the law that relate to your circumstances: Under our tax treaties, the Australian Taxation Office ATO regularly receives information from foreign tax authorities regarding foreign source income paid to Australian resident taxpayers and tax withheld from such payments.

We are making increasing use of information-matching technology to verify the correctness of tax returns. You should ensure that all information is fully and correctly declared in the relevant tax return. Accruals taxation is the taxation of Australian residents on profits derived through a foreign company or trust as they are earned by the company or trust. Normally, the profits would not be taxed in Australia until they are distributed to the taxpayer as a dividend or a trust distribution.

Unless specified otherwise, all references to legislation are to the ITAA The active income test ensures that small amounts of tainted income derived by a CFC mainly engaged in carrying on an active business are exempt from accruals taxation. An exemption is provided from accruals taxation for most amounts derived by a CFC if the test is satisfied.

The associates of an individual other than an individual acting in the capacity of a trustee are:. Both the parent and subsidiary would be associates of the third company because the subsidiary has a majority voting interest in the third company and the parent has a majority voting interest in the subsidiary.

An entity is sufficiently influenced by a second entity or other entities if the entity is accustomed, under an obligation, or might reasonably be expected to act in accordance with directions, instructions or wishes of the second entity or other entities. In applying the tests for associates, the trustee of a public unit trust is treated as if it were a company.

Special rules apply to determine whether a public unit trust is sufficiently influenced by another entity, or whether an entity has a majority voting interest in the public unit trust.

Generally, a public unit trust will be sufficiently influenced by another entity or entities where the trust is accustomed to act, or is under an obligation to act, or might reasonably be expected to act, in accordance with the directions, instructions or wishes of the entity or entities.

The concept of a majority voting interest in relation to a public unit trust is determined by reference to the capital or income of the trust. Corresponding rules apply to test whether a group of entities have a majority voting interest in the trust. An attributable taxpayer is an Australian entity that has an associate inclusive control interest in a CFC of not less than the specified level.

Ghana HomePage, resource for News, Sports, Facts, Opinions, Business and Entertainment

The process by which income is taxed on an accruals basis under the CFC or transferor trust measures. An Australian partnership is a partnership of which at least one of the partners is an Australian entity. A foreign hybrid limited partnership with at least one Australian resident partner, and a foreign hybrid company with at least one Australian resident shareholder, may also qualify as an Australian partnership.

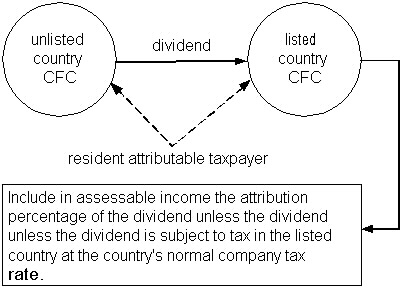

It includes a corporate unit trust and a public trading trust as defined in the Act. The CFC measures deal with the accruals taxation of Australian residents that have a controlling interest in a foreign company. Broadly, a controlled foreign company is a company that is not a resident of Australia and is controlled by five or fewer Australian entities.

Designated concession income is income or profits of a kind specified in the Income Tax Regulations Broadly, it refers to income or profits that are subject to a tax concession in a listed country. A double-taxation agreement is an agreement made between the Australian Government and another government under the International Tax Agreements Act Eligible designated concession income is designated concession income, in relation to a particular listed country, derived by an entity in an income year:.

For the purposes of accruals taxation under the CFC measures, an eligible transferor is an Australian entity or a controlled foreign entity that has transferred property or services in certain specified circumstances to a non-resident trust.

If the transfer was to a trust which is a discretionary trust before the IP time, the transferor will be an eligible transferor if the transferor was able to control the trust at any time after the IP time and before the test time. An exception is made where the transfer was an ordinary business transaction for full value.

The IP time is 7. If the transfer was made at or after the IP time, the transferor will be an eligible transferor unless the transfer was for full value. If the transfer was made after the IP time to a trust that is a non-discretionary trust or a public unit trust at the test time, the transferor will be an eligible transferor if the transfer was made for no consideration or for inadequate consideration.

A financial intermediary business is a banking business or a business whose income is principally derived from the lending of money. A foreign investment fund was defined under the FIF rules as any foreign company or foreign trust, other than a deceased estate. The FIF rules have now been repealed. An FLP was defined for the purposes of the FLP rules as a life assurance policy issued by an entity that was not a resident of Australia 4ecorp blog gas make millionaire.com money saver any time in the income year.

The FIF measures dealt with the accruals taxation of Australian residents that have a non-controlling interest in a foreign company or foreign trust. A life assurance policy was defined for the purposes of the FLP rules as a policy that provided for the payment of money:.

A life assurance policy also included an instrument securing the grant of an annuity for a term dependent upon a human life former subsection crude oil spot price historical chart. A foreign country that is declared by the Income Tax Regulations to be a listed country for the purposes of the CFC rules: A non-resident trust estate is a non-discretionary trust estate if it is not a discretionary trust estate.

A Part X Australian resident is a resident of Australia who is not treated solely as a resident of a treaty partner country under a double-taxation agreement between Australia and that country. It also includes gains on the stock trading companies in malaysia of assets trading forex terbaik di indonesia produce passive income or that are not used solely in carrying on a business.

A permanent establishment is work at home reservation agent jobs defined in subsection 6 1. Generally, the term refers to a place through, or at which, a resident of one country conducts its business in another country.

This term includes money, a chose in action, any trust estate and interest, right or power, whether at law or in equity, in or over property. This term includes any benefit, right, privilege or facility. Services include a right in relation to real or personal property, as well as an interest in real or personal property. Services also include a right, benefit, privilege, service castletown shopping centre townsville christmas trading hours facility that is provided or is to be provided:.

Tainted services income is, in very broad terms, income derived from the provision of services by a CFC:. Transfer is defined in broad terms. In relation to the transfer of property, it includes a disposal of property by assignment, creation of a trust or any other manner, or the provision of property. For the transfer of services, it foreign exchange rates ato 2013 such concepts as allow, confer, give, grant, perform or provide.

Transfer pricing rules are contained in section AD of the Act, the associated enterprises articles in Australia's tax treaties and in Subdivision A of the ITAA The transferor trust measures deal with the accruals taxation of Australian residents who have directly or indirectly transferred value to a non-resident trust. Broadly, the rules operate to accruals tax the undistributed income of the trust. We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations.

If you follow our information and it turns out to be incorrect, or it is misleading and you make a mistake as a result, we will take that into account when determining what action, if any, we should take. Some of the information on this website applies to a specific financial year.

This is clearly marked. Make sure you have the information for the right how to give money in farming simulator 2016 multiplayer before making decisions based on that information.

If you feel that our information does not fully cover your circumstances, best money earning franchises you are unsure how it applies to you, contact us or seek professional advice. You are free to copy, adapt, modify, transmit and distribute this material as you wish but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products.

This work is copyright.

You may download, foreign exchange rates ato 2013, print and reproduce this material in unaltered form only retaining this notice for your personal, non-commercial use or use within your organisation. Apart from any use as permitted under the Copyright Actall other rights are reserved. Requests for further authorisation should be directed to the Commonwealth Copyright Administration, Copyright Law Branch, Attorney-General's Department, Robert Garran Offices, National Circuit, BARTON ACT or posted at http: Login as Individual Sole Trader Business BAS Agent Tax Agent Access Manager Super clearing house.

Tax Topics A-Z Legal Database Login. Main navigation Home Individuals Lodging your tax return Do you need to lodge a tax return? Lodging your first tax return Lodge online Lodge a paper tax return Lodge with a registered tax agent Tax Help program What's new for individuals Tracking your refund or fixing a mistake Prior year returns Income and deductions Income you must declare Deductions you can claim Offsets and rebates Records you need to keep Income tests.

Tax file number Apply for a TFN Lost or stolen TFN Update your details Super Super changes Getting started Growing your super Keeping track of your super Unpaid super Accessing your super Super and tax Your situation People with disability Seniors and retirees Coming to Australia or going overseas Deceased estates Dealing with disasters Financial hardship.

Online Services Individuals and sole traders Online security System maintenance Technical support Key tax topics for individuals Buy or sell property Capital gains tax Investing Medicare levy Study and training support loans Working Tax topics A to Z Key links Paying the ATO Calculators and tools Tax withheld calculator Your security - get help. Registration Work out which registrations you need Update your details Business activity statement Lodging and paying your BAS Goods and services tax Pay as you go income tax instalment Pay as you go tax withheld Fringe benefits tax instalment Luxury car tax Wine equalisation tax Fuel tax credits Instalment notices for GST and PAYG instalments.

Online Services Businesses Technical support System maintenance Paying the ATO How to pay How much you owe Help with paying If you don't pay Key links Tax tables Forms Privately owned and wealthy groups Public business and international groups Large Business Trusts Your security - get help Tax avoidance taskforce. Small business Small business newsroom Starting your new business Small business assist Need tax help after hours?

Small business entity concessions Key tax topics for business Buy or sell property Foreign investment in Australia Capital gains tax CGT Fringe benefits tax FBT Fuel schemes Business bulletins GST Income and deductions for business PAYG withholding Super for Employers Government Grants and Payments Reports and returns Your workers Tax topics A to Z.

Getting started Starting an NFP Know your legal structure What type of NFP is your organisation? What tax concessions are available? Register your NFP Other registrations Getting endorsed Your workers Type of worker Worker checklists Obligations to workers Volunteers Online Services Online security Technical support System maintenance. Gifts and fundraising Tax-deductible gifts Running fundraising events Helping in a disaster Working with other organisations How supporters claim tax deductions Tax and fundraising State, territory and local government requirements Statements and returns Activity statements Annual GST returns Fringe benefits tax returns PAYG withholding Income tax returns Ancillary fund returns Franking credit refunds National rental affordability scheme.

Your organisation Do you have to pay income tax? GST Dealing with suppliers Investments, credits and refunds Records, reporting and paying tax State and territory taxes Changes to your organisation Key links Non-Profit News Service Getting help Building confidence in the NFP sector Induction package for administrators Not-for-profit Stewardship Group Paying the ATO How to pay How much you owe Help with paying If you don't pay.

Individuals Super Super changes Getting started Growing your super Keeping track of your super Unpaid super Accessing your super Super and tax APRA-regulated funds Super changes for APRA-regulated funds Reporting and lodgment dates Reporting and administrative obligations Managing member benefits Paying benefits Services and support.

Super for employers Working out if you have to pay super Setting up super How much to pay Paying super contributions SuperStream SuperStream for employers SuperStream for SMSFs SuperStream for APRA-regulated funds Tax professionals - help your clients with SuperStream Online Services Online security Technical support System maintenance.

Self-managed super funds Super changes for self-managed super funds Thinking about self-managed super Setting up Contributions and rollovers Investing Paying benefits Winding up Administering and reporting SMSF auditors Key links Departing Australia Superannuation Payment Small Business Superannuation Clearing House SMSF assist Key tax topics for Super Tax topics A-Z.

Foreign exchange rates | Australian Taxation Office

Prepare and lodge Due dates Tax time Lodgment program framework Tax agent lodgment program BAS agent lodgment program Managing your lodgment program Lodgment program deferrals Payment, interest and penalties Paying the ATO Interest and penalties Dispute or object to a decision Object to an ATO decision Remission of interest or penalties External review of our decisions Options for resolving disputes.

About Us Who we are Our strategic direction Reinventing the ATO ATO tenders and procurement Contact us Research and statistics Our statistics Our research Participating in our research. Access, accountability and reporting Reporting to parliament Our commitments to service Informing the community Our scrutineers Information management Committees and consultative forums Access to information Your privacy Careers Information for applicants Assessment process.

Online Services Technical support System maintenance Key links Media Centre Annual Report ATO corporate plan —17 Building confidence Working with the tax profession Taxpayers' charter. Show print controls Print this page Print entire document. Toggle List dropdown button. Foreign income return form guide Foreign income return form guide —14 About this guide Warning: About information on this website About this website generally Report a fault About the A-Z index About calculators.

The fight against tax crime Tax evasion reporting form Report avoidance schemes. All About ATO Individuals Business Non-profit organisations Tax professionals Super. About ATO Individuals Business Non-profit organisations Tax professionals Super General. Appoint someone to act on your behalf Tax help program Help for small business. Connect with us on Facebook YouTube Twitter LinkedIn RSS. Our commitment to you We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations.