Ichimoku forex

Ichimoku Kinko Hyo IKH is an indicator that gauges future price momentum and determines future areas of support and resistance. Also know that this indicator is mainly used on JPY pairs. Kijun Sen blue line: Also called standard line or base line, this is calculated by averaging the highest high and the lowest low for the past 26 periods.

What is the Ichimoku Indicator and how do you use it?

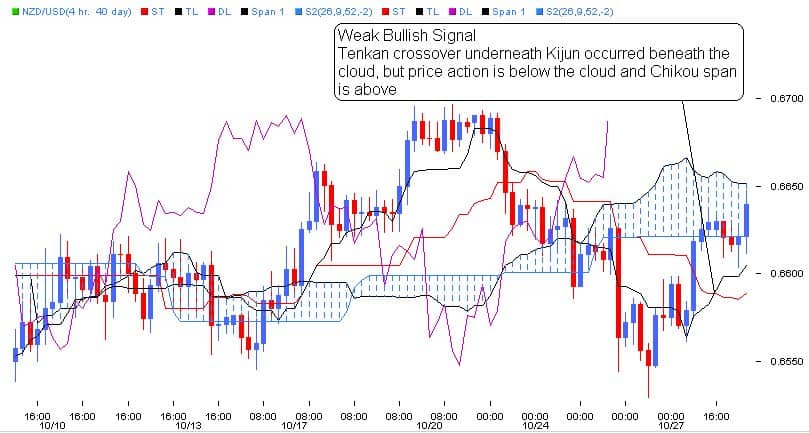

Tenkan Sen red line: This is also known as the turning line and is derived by averaging the highest high and the lowest low for the past nine periods. Chikou Span green line: This is called the lagging line. Senkou Span orange lines: The first Senkou line is calculated by averaging the Tenkan Sen and the Kijun Sen and plotted 26 periods ahead.

The second Senkou line is determined by averaging the highest high and the lowest low for the past 52 periods and plotted 26 periods ahead. If the price is above the Senkou span, the top line serves as the first support level while the bottom line serves as the second support level.

If the price is below the Senkou span, the bottom line forms the first resistance level while the top line is the second resistance level. We introduce people to the world of currency trading, and provide educational content to help them learn how to become profitable traders. We're also a community of traders that support each other on our daily trading journey.

Ichomoku Kinko Hyo Indicator

BabyPips The beginner's guide to FX trading News Trading. How to Trade Forex Trading Quizzes Forex Glossary. School of Pipsology Elementary Popular Chart Indicators.

Partner Center Find a Broker. Trading with Multiple Chart Indicators. Support and Resistance Levels. Privacy Policy Risk Disclosure Terms of Use.